Participation vs. Consumption. Or why Pickleball makes John McEnroe want to throw up.

Sports technology industry insights, news, and analysis. Brought to you by STWS.

Welcome back to Sports Tech Feed! This week we use the lens of Pickleball’s rapid growth to understand the challenges of converting sports participation into sports viewership. We also look at highlights from Drake Star’s Global Sports Tech Report reporting an unprecedented year for sports tech investment.

Pickleball Wins Participation Trophies

Pickleball has cemented itself as the fastest-growing participation sport in the US with more than 36.5 million people playing between August 2021 and August 2022.

According to research from the Sports and Fitness Industry Association, participation nearly doubled in 2022 increasing by 86% year-over-year, and by an astonishing 159% over three years.

For the uninitiated, Pickleball is a racquet sport played both indoors or outdoors on a badminton-sized court and a slightly modified tennis net. It combines many elements of tennis, badminton, and ping-pong with a focus on attracting players of all ages and abilities. The rise of Pickleball in the US has been mirrored across the pond by the explosion of Padel in Europe.

The emerging sport has generated new professional leagues and teams with celebrity investors including Tom Brady, LeBron James, and Mark Cuban, betting this grassroots participation can translate into a profitable and sustainable professional product.

Sports Biz 101: Broadcast = $$$

As we previously discussed, the traditional sports business model is driven by big broadcast deal(s), supplemented by local sponsorship and ticket sales.

By comparison, Esports is on the other end of the spectrum with minimal or even free broadcast deals and an overreliance on sponsorship.

Disruptor leagues in traditional sports (e.g. Overtime) are somewhere in the middle balancing broadcast deals and sponsorship deals, driven by social media engagement.

Even though it’s a relative startup it appears Pickleball is pursuing the traditional route: this week the Professional Pickleball Association (PPA Tour) announced a deal with CBS Sports to broadcast over 30 hours of coverage for their 2023 season. The Association of Pickleball Professionals (APP Tour) announced similar TV deals with CBS and ESPN earlier this year.

In A Pickle Over Fans Doing, Not Watching

But will Pickleball's strengths as a participation sport guarantee it will be a successful spectator sport?

New research from Morning Consult suggests the opposite, with 44% of sports fans reporting no interest in watching the sport on TV or live streaming.

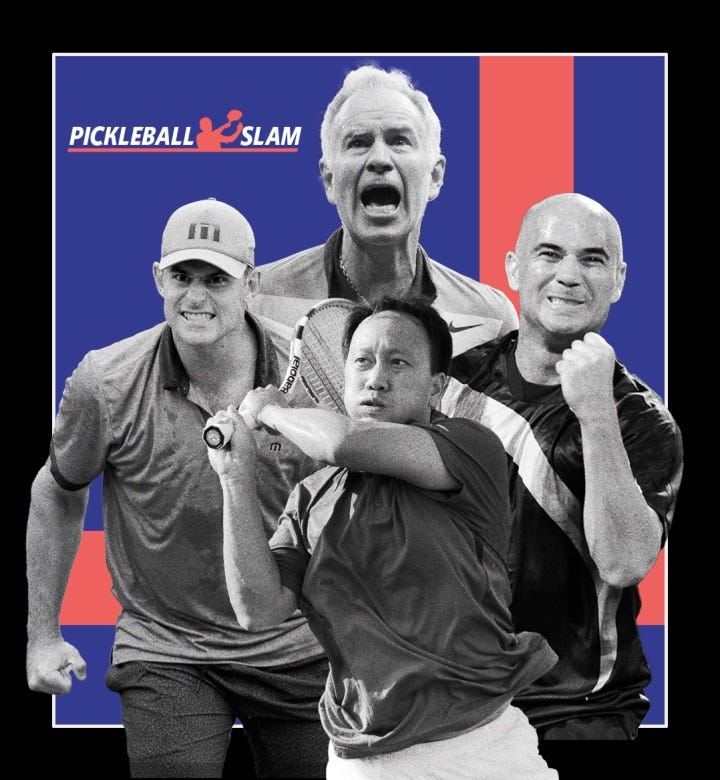

Proponents of the sport’s broadcast potential point to the viewership stats from this month’s inaugural “Pickleball Slam” exhibition event broadcast on ESPN. The event featured a pair of singles matches and a doubles showdown pitting retired tennis superstars John McEnroe and Michael Chang against Andre Agassi and Andy Roddick for a $1M prize purse.

According to Nielsen live-plus-same-day data the broadcast averaged 237,000 adults under 50, tying TNT’s Bruins-Blues NHL game as the day’s fifth highest-rated sporting event.

Within the context of the entire programming week (March 27th - April 2nd), the event had more viewers than 13 nationally televised MLB games, five NHL games, and seven NBA games!

Impressive stats even for a celebrity showcase, but we suspect those names would get a considerable pull regardless of the sport.

Some typically honest pre-match comments from John McEnroe to the Pat McAfee Show and Miami Herald might also temper the excitement:

“If I hear one more time that pickleball is the fastest-growing sport I’m gonna throw up.

It’s hard to imagine something small like pickleball being great on TV. It’s like watching ping-pong on TV. Tough to see how that can really work.

— John McEnroe (Professional Pickleball Athlete)

Technology Has A Role To Play

So even if we take John’s constructive criticism and run with it, how can you make Pickleball more engaging as a broadcast product?

The Morning Consult report identified investing in technology including better quality production and adding new components for broadcasts, including improved camera technology and betting integrations.

As with disruptor leagues, Pickleball has the unique challenge but also the opportunity of creating, refining and innovating the product as they go, unencumbered by the “this is how it’s always been” mentality.

For example, the Premier Lacrosse League has live mics on players and even referees as a way to promote big personalities being sought in the “Drive to Survive” era.

As fan engagement expert Richard Ayers identified, the ultimate competitive edge is to get fans fully immersed in what they’re watching and experiencing. Technology unlocks that potential. (Side note: Richard also used John McEnroe to pull in fans, albeit a younger version).

How do you define success?

Now with all that said, can pickleball take on the major incumbent sports? Maybe. Probably not. But more importantly, does it have to?

As Steve Kuhn, founder of Major League Pickleball, told the NYT:

“If this is the most played sport in America, it might not be the most watched sport in America, but it will be up there.

It’s going to be hard to beat the NFL. Could it be in the top five? Yeah. I project it will be. I might be wrong, but the thing is, I could be wrong in terms of where we’re valuing the league now and still be right.”

Just don’t tell John.

What we’re reading: Global Sports Tech Report 2022

Global investment bank DrakeStar released its annual Sports Tech Report, providing a succinct summary of M&A, fundraising, and investment activity for the sector. The biggest takeaway is that 2022 was an unprecedented year for sports tech, breaking every previous record with $90B in deal value across 1,000+ announced deals.

$78.3B in disclosed M&A activity, over 6x increase over 2021 with the help of 235 announced M&A deals.

Fantasy, Esports & Betting segment saw the largest deal activity, Fan Engagement / Experience segment reported over 70% increase in deal volume.

Over $5B of new funds were raised by financial investors and buyers… even with a forecast economic downturn, this bodes well for the future health of the industry.