Crystal Ball Gazing. Or what does the future hold for sports tech investments.

Sports technology industry insights, news, and analysis. Brought to you by STWS.

Welcome back to Sports Tech Feed! This week we spoke with Janis Burke (CEO, Harris County - Houston Sports Authority) about the role of local host cities in the FIFA World Cup with the event coming to Houston in 2026. We also look at why the first Nasdaq-listed Esports company is at risk of being delisted as well as our major predictions for sports tech investment in 2023.

Hosting the World’s Biggest Sporting Event.

Local sports commissions and authorities are responsible for driving economic impact by attracting major sporting events to their city, usually through incentives including tax breaks. The theory goes big events bring in the masses to spend money on local businesses (accommodation, retail, restaurants, etc). The tax generated from “heads on hotel beds” is in part returned to the operating budget of the sports commission. Rinse and repeat ad nauseum.

The Houston Sports Authority is in a unique position in that it also owns the $1.2 billion dollars of bond debt service for the city’s professional sports stadiums, making it both partner and landlord to the teams. This means that its remit is beyond just attracting the big events but also has to answer the question of what legacy should this public investment in sports return for the city and its constituents?

Janis Burke has been with the Houston Sports Authority for 17 years so is uniquely placed to answer this question, as well as what role technology can play in being part of the delivery and legacy of major events. Listen to the full interview on your podcast platform of choice.

Esports Team Valuations: Not Up And To The Right

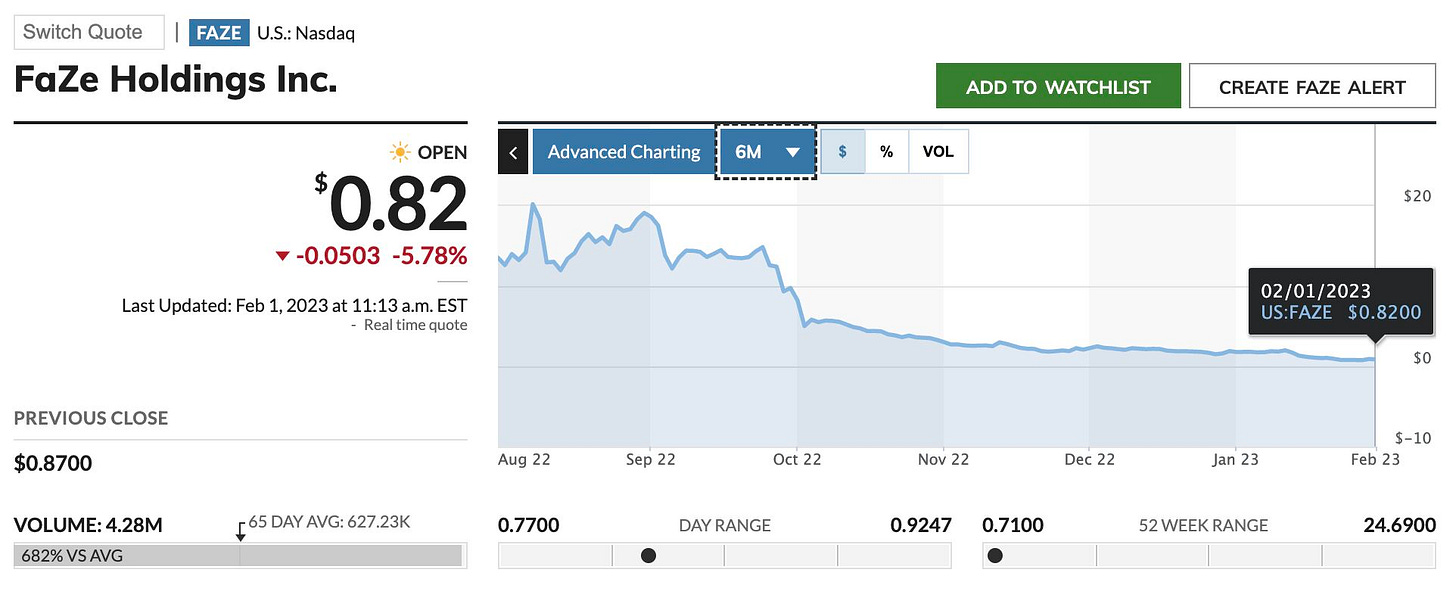

On July 20th, 2022, FaZe Clan became the first Esports & Gaming Lifestyle brand listed on the Nasdaq. Today, it risks being delisted for trading below $1.

In our STWS Esports & Gaming Market Report 2022 sponsored by Tipalti and BIG Esports, we stated that:

"FaZe Clan typifies the potential growth but also the struggles of esports teams to become sustainable, diversified businesses."

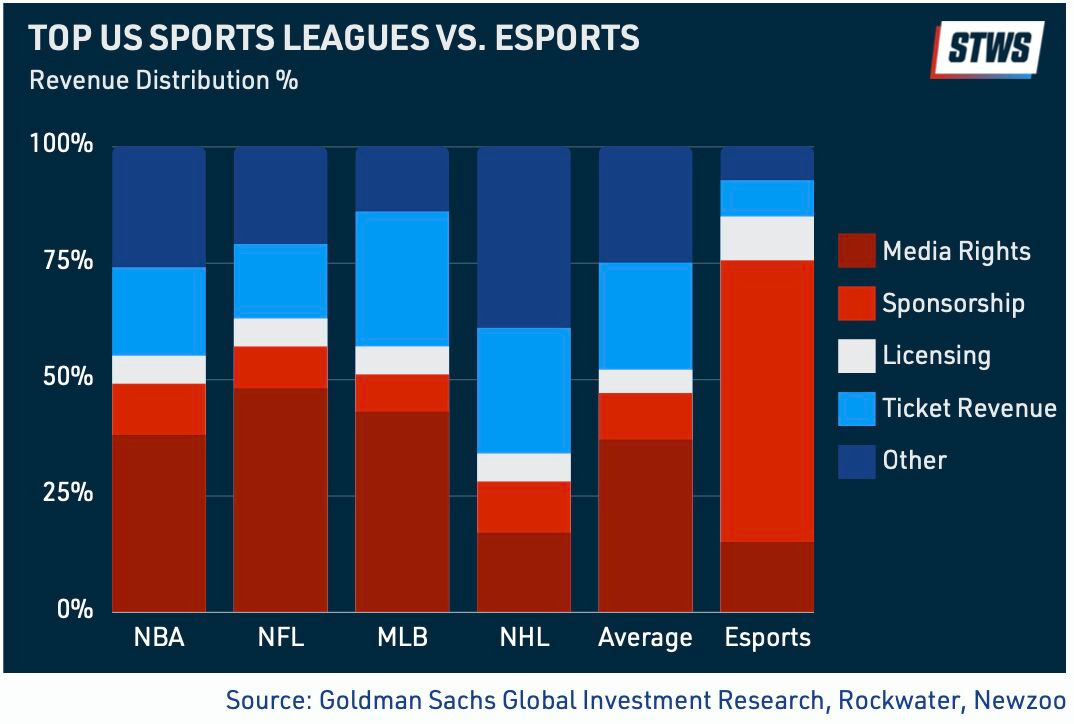

With more than $50 billion paid annually on sports media rights internationally, broadcasting and media rights are the single largest source of revenue for almost every major professional sports league.

If we compare the distribution of revenue sources above it illustrates the difference in business models and the precarious financial position many esports teams find themselves in without this guaranteed annual media rights revenue (supplemented by ticket revenue). Sponsorship as a category is more immediately sensitive to macroeconomic forces than the longer-term media rights cycles.

Time will tell whether FaZe Clan can pull up out of this nosedive but the outlook isn't good and may prove to be a cautionary tale for other organizations looking to follow in their footsteps.

If you'd like to learn more about the Esports, Gaming, and Streaming Market then the full report is available for free download here.

What we’re reading: 2023 Sports Tech Investment Predictions

SportsPro Media is back with its Investor Roundtable: Sports tech experts on the trends, startups, and innovations to watch in 2023. Yours truly was featured again alongside a humbling batch of industry experts for what the year ahead holds for sports tech investment.

The good news? There are still smart investors looking to deploy capital into quality sports tech companies. (e.g. Courtside Ventures just announced a US$100 million fund as did Sapphire Sport with a US$181 million fund, KB Partners closed their second US$127 million fund in November 2022).

The bad news? This ongoing access to capital is that investments won’t be on terms or at valuations startups would have enjoyed 12 to 18 months ago

The other good news? Restraint in valuations is a good thing. Per Sports Loft’s Charlie Greenwood:

I think what we are seeing at the moment is a greater focus on company quality and that fundraising rounds are being done at a more realistic multiple. That’s probably only a good thing as there are certainly instances where founders have been too ambitious on their valuations and have priced themselves out of the market. It also means that investors are doing their due diligence properly.

Check back in here next year to see what we got right and/or wrong.