Esports is Dead. Or why the reports of Esports death are greatly exaggerated.

Sports technology industry insights, news, and analysis. Brought to you by STWS.

Welcome back to Sports Tech Feed! The team at STWS just published the 2023 edition of our Esports & Gaming Market Research Report so we’ve got some key insights from this jam-packed 59-page (free!) report.

Understanding Esports, Gaming & Streaming.

Our annual STWS Esports & Gaming Market Report, sponsored by our friends at Tipalti and BIGR, aims to help you understand the global esports, gaming and streaming ecosystems. We use an in-depth analysis of market data combined with insights from interviews with global industry experts. Let’s dive into some of the key findings.

Unplugged: The Esports Party is Over

Esports witnessed explosive growth over the last five years with substantial investments leading to inflated valuations. But in 2023 economic downturn, combined with high operating costs, a lack of diversified revenues, and freezing of outside investment, has led to a collapse in team valuations and mass layoffs in the industry.

However, the "Esports Winter" prompts a chance for the industry to reset, emphasizing viable business models for a leaner and more sustainable future.

More on that later, but for now, how did we get here?

Esports was once billed as investing in the future of sports.

According to Deloitte, investment by Venture Capital (VC), Family Office, and Private Equity (PE) firms in esports teams exploded from $1 million in 2016 to $65 million in 2017 and $193 million in 2018. Times were good and the money tap was on.

During this frenetic period of investment most high profile esports teams focussed on “growth” rather than profitability. Esports teams have legions of dedicated fans but have struggled with finding a sustainable business model that best monetizes this fandom. Illustrated by comparing the distribution of revenue sources between traditional sports and esports

Sponsorship accounts for over 60% of total revenues for esports teams. Sponsorship deals are typically on shorter terms than the 5-10 year media rights deals in traditional sports, giving esports less long-term stability over guaranteed revenues.

Without this long-term, guaranteed annual revenue, esports teams are especially vulnerable to a pull back in ad spend from brands/sponsors. Which is exactly what we’ve seen over the last year as consumers feel a cost of living crunch.

But they can just raise more money right?

Unfortunately for these teams, investment returns have not matched the unrealistic valuations resulting in a collapse of team valuations and curtailing further investment. Now esports is a cautionary tale for many investors and the money tap has been very firmly shut off: Excluding the pandemic affected year of 2022, VC investment in esports is at its lowest since 2016.

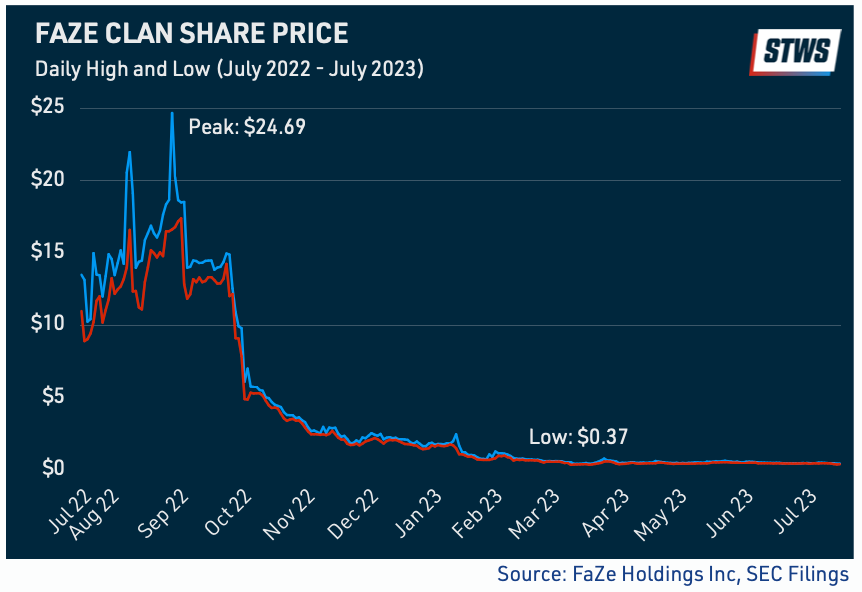

To paraphrase Warren Buffett, the tide has gone back out and we can tell who’s been swimming naked. The FaZe Clan share price is an adequately ugly looking example.

Game Publishers aren’t exactly helping

The struggles of professional esports teams to make a go of it can’t all be laid at the feet of the teams. This boom/bust was further fueled by game publishers happy to hype the growth prospects of their leagues. But without doing much to support them.

Unlike traditional sports, where the league and team work collaboratively to grow the value of the entire ecosystem, game publishers’ incentives are not always aligned with their teams'.

The game titles played by esports teams are the intellectual property (IP) of the game publishers that create them. Because esports do not control the IP of the games played, they are limited in how they can generate revenue and have limited power to influence the publishers to direct resources toward growing their league.

However, game publishers can afford to operate esports leagues as loss-leading marketing initiatives to drive interest and participation in their revenue-generating video game titles. This means publishers can sometimes prioritize growth and exposure over sustainable revenue for the league.

This is highlighted by news earlier this year that the majority of teams in the Overwatch League, owned by game publisher Activision Blizzard, retained a law firm to begin a collective bargaining process against the league. Each franchise spent in the range of $7.5 to $10 million in franchise payments since 2018 and are seeking financial relief from the league for missing promised revenue goals.

Whereas Activision Blizzard’s Q2 2023 financial statement states that the total revenues from their Overwatch League:

“Comprise less than 1%” of the company’s consolidated net revenues”. Furthermore, the company cautioned a risk in their “Ability to effectively manage the scope and complexity of our business, including risks related to our professional esports business model.”

Not exactly a vote of confidence.

Hope for an Esports Spring

Although outside investment rapidly accelerated the valuations of professional esports, these teams and the communities that support them had been organically growing for many years prior to this. There are still a huge amount of incredibly dedicated fans of esports teams and their athletes keen to see them succeed.

With the reset offered by the pullback in investment, esports teams have the opportunity to focus on a leaner business model while investing in the more profitable aspects of their business, including those enabled by the creator economy.

Content Creators Creating Cash

Rather than operating as pure-play professional teams driven by sponsorship and prize money, esports teams are pivoting their focus to be entertainment and lifestyle brands, agencies, and game developers.

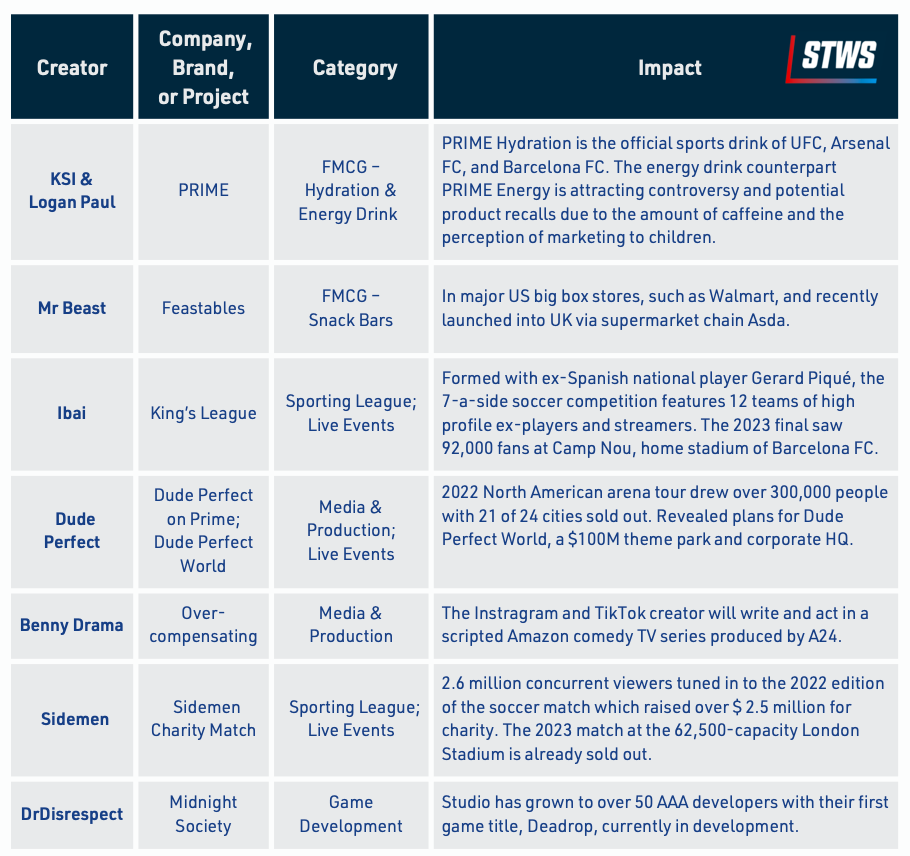

Much in the same way that Content Creators have branched out from the traditional monetization channels (brand endorsements, subscription / ad payouts, merchandise sales) to new diversified revenue streams including FMCG and live events.

What else are the key takeaways from the report?

I’m glad you asked. Here are some highlights which we’ve expanded on in the report:

Live Streaming Wars: Twitch getting a Kick(ing)

While Twitch maintains its live streaming crown, upstart newcomer Kick has surged in market share since its 2023 launch. Boasting unrivaled creator revenue sharing and high-profile deals, Kick has attracted streamers and viewers alike. Further exacerbated by Twitch's rocky relations with its creators after attempts to stifle content monetization. However, questions remain on Kick's long-term viability as an alternative to Twitch and YouTube Live.

Gaming IP Crossover: Super Mario Dollars.

The seamless infusion of gaming IP into movies and TV highlights gaming's central role in the media and entertainment industry. A prime example is "The Super Mario Bros. Movie" surpassing $1 billion in global box office earnings entering the top 20 highest-grossing films of all time, and HBO’s critically acclaimed adaptation of “The Last of Us”.

AI Disruption & Benefits: Sometimes good, sometimes not so good.

Unlike disappointments with Metaverse and Web3 use cases, Artificial Intelligence (AI) is having an immediate and tangible positive impact on esports, gaming, and streaming. Current and future applications of generative AI in particular encompass efficiencies for creators, cost cuts in game development, democratized dev tools, and enriched gaming experiences. However, concerns exist about copyright infringement for creators and job obsolescence for game developers.

What We’re Reading: Our Sports Tech Feed Back Catalogue

We’ve got a dozen past post of industry insights on how technology is disrupting and improving sports, as well as 120 podcast episodes with the brightest minds in sports globally. Go for it!

This Is Your Captain Speaking.

here with a personal note: This will be my final edition with Sports Tech Feed. Thank you to our podcast guests for graciously sharing their expertise with us over 120 episodes(!) and to everyone who has listened, read, and supported the podcast and newsletter during my tenure here.Even though I’m moving on,

will remain your best source to stay ahead of what’s happening in the world of sports technology and I look forward to reading future editions.